ABOUT US

Whether to hire a business consultant or not is a decision every business will have to make. The questions like this are kept into their mind. “ Do I like the people with whom I will potentially be working? Do their goals for the business line up with mine? Are they qualified enough to let my business run smoothly?”.

Yes, of course wrong business consultant can cost a lot of money, but with the right business consultant, whether for a majority buyout or a minority growth investment or as your business and quality management consultant for, is a major decision that will impact not only the future of your company, but also your own personal business objectives

1STOPVN-APPROACH

One of the keys to successful investing is Alignment of interests. 1StopVN company evaluates the degree of interest alignment to identify short and long opportunities. Along with long-term investments, we look for the best essential alignment between consumer value, company profitability, management incentives and stock market.

You’ve worked tirelessly to get your business to this point. You’ve invested time, energy, money and emotion. 1stopConsultant will make a priority to understand what the business means to you personally and ensure we are aligned with your vision for the future before signing on. So, will we become a good fit for the culture you have created at your company?

Due Diligence aims at helping the customers have an explicit look at the financial issues of the company, including the hidden liabilities, the quality of asset, profit, tax risks, …and all financial issues probably incurred explicitly by consumers.

This service is used to provide an elaborate report presenting all related information and explanation for each component of the financial statements of the target. Clients use this report to agonize their decision on whether to proceed with investment or employ reasonable investment strategies.

You can expect that any consultant business investing significant resources into your company will conduct an intensive due diligence process before a transaction is completed. That said, diligence is a two-way street. Make a concerted effort to learn vital information about our potentials. We are more than willing to accommodate reasonable requests to authenticate our track record.

Traditional/institutional investment firms will have a specific time frame they must follow on behalf of their underlying investors. Have a conversation about how long they want to be involved and what options they would consider for exiting their investment. Additionally, it is imperative to understand how this time frame will impact the strategies they use to realize returns over a specified timeframe, but it does not focus on what is more important: long-term, sustainable value creation.

Compare to a traditional private equity firm, we would maintain our investment in your business for longer time, until we recognize that the timing and next owner are exactly the right fit. We believe that it is the best investment strategy for enabling your business to achieve responsible, sustainable growth and preserving the legacy you have built.

We narrow the gaps that can often stand between companies and their actual potential. All of our partner companies benefit from this added value—it’s the essence of our relationships. Our operational team and financial executives are experts in working with management teams to accelerate performance and value through key initiatives tailored to the needs of the business. Our partnerships are set up and thrive upon the alignment and open communication of our teams. Companies live and die by the people involved, and we take that to heart in everything we do.

Future growth is not just about the financial capital being injected into business. A truly value-additive partner and consultant will be able to help you tackle issues your company is facing. Make sure the potential partner and consultant has the needed experience, network in your geographic area and business chops to help create value. Getting to know the capabilities of the team they bring to the table will help you access if they can truly help move the needle.

Build and maintain partner bridges

OUR SERVICES

Website Design Services

Website design consultancy is one of special services provided by 1StopVN for customers

Office Services

1StopVN offers office services to help businesses save a large amount of cost with full and high-quality facilities.

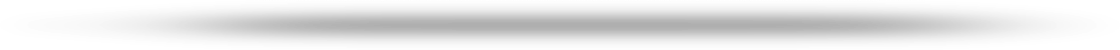

IT Services

Updating the latest technology solutions plays an important role in developing and keeping pace with domestic and international businesses.

Digital marketing

Google Adwords / Facebook Marketing

Market Survey

From collecting customer service feedback to understanding how consumers see your brand, our marketing templates and sample surveys will give you the data you need to form the right marketing strategies.

Agriculture & Farming services

Our agricultural and farming services provide information, consulting, equipment to your agricultural business

Cloud Storage Service

To collaborate and share files across teams or locations while also considering data governance and privacy, Synology combines the flexibility of the cloud with control of on-premises file services.

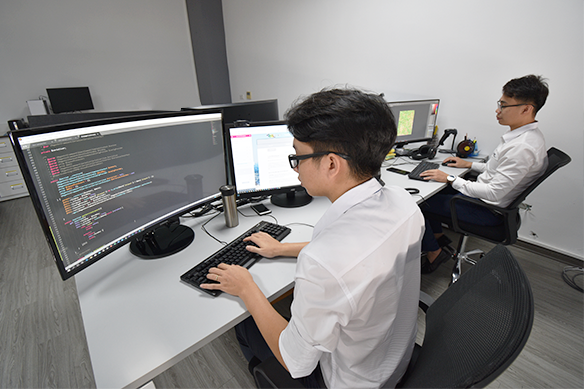

GECO Vietnam Services

Quailty | Integrity | Value

Our Hallmark of Success for our Customer

IT SAP Digtal Platform

Investment Consultants

To support foreign investors, 1Stop Consulting Business Solutions Co., Ltd. is willing to provide investment advisory services to foreign investors who want to invest in Vietnam

Group Members

Equity Investment Portfolio

ReXil Asia

Dedicated to development and sale of innovative, effective, safe and eco-friendly agro-products and technologies

Pharmact Asia

At PharmACT is whose purpose is to improve the health of those they serve.

SynjectosVN

Synjectos is used in all areas of Traumatology and Orthopaedics that deals with bone loss during surgery and/or after trauma.

CrewSkills

A team of Experts from all over the World to train the next generation of Chefs